Apply Now

How to Apply

Our Offerings

Grants & Recoverable Grants

Capital Needs Assessment Recoverable Grant Program

Developers of Color (DOC) Matching Grant Award

Loans

Low Interest Subordinate Mini-Perm Loan

Low Interest Preservation Acquisition Mini-Perm Loan

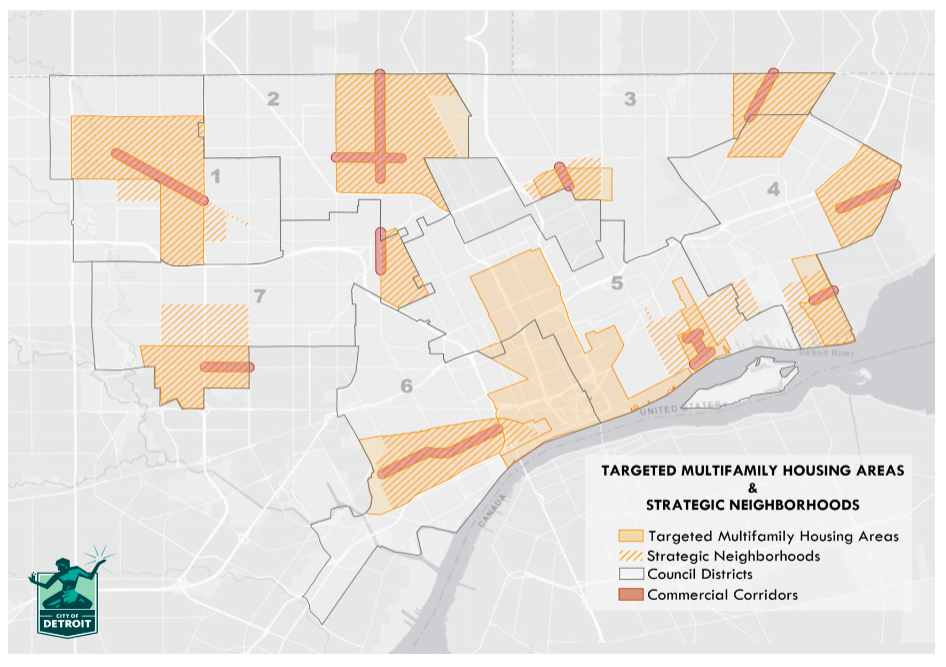

Targeted Housing Area Map

This is a disclaimer of the applications. This is a disclaimer the funds here are not city funds.

Capital Needs Assessment & Green Capital Needs Assessment Recoverable Grant Program

Description:

This grant

cover costs of a 3rd party Capital Needs Assessment.

is for owners of regulated affordable housing or Naturally Occurring Affordable Housing (NOAH) projects in Detroit that need to understand the capital needs of their projects.

Eligibility:

Owners or purchasers of existing regulated or Naturally Occurring Affordable Housing projects willing to preserve unit affordability.

Developers of Color (DOC) Matching Grant Award

Description:

This is a grant program that offers up to $25,000 in matching funds to cover a portion of a project’s predevelopment expenses and soft costs for developers of color. The Developer of Color (DOC) program will provide predevelopment capital to affordable housing projects over five years.

Eligible Grantees:

Non-profit (Organization lead is of color, majority of board is of color)

For-profit developers of color

Less experienced developers of color working with an experienced consultant

Project Eligibility:

Development projects must be in the City of Detroit

Applicants must demonstrate ownership or have site control in process

Evidence of property insurance

Projects must be intended to substantially serve as affordable housing, either

restricted or naturally occurring affordable housing (NOAH)

Projects must be on schedule to close on permanent financing within two years

Low Interest Subordinate Mini-Perm Loan

Description:

This loan

Allows for refinancing of existing debt up to $2 million

Is intended for multifamily buildings of 75 units or less, but not exclusively.

Covers renovation costs projected at moderate level per unit .

Affordability requirements:

At least 50% of units must be at 80% AMI or below

Remaining 50% of units at 120% AMI or below

Low Interest Preservation Acquisition Mini-Perm Loan

Description:

This loan

allows for refinancing of existing debt up to $5 million

is intended for multifamily buildings of 75 units or less, but not exclusively.

covers renovation costs projected at moderate level per unit.

Affordability requirements:

At least 50% of units must be at 80% AMI or below

Remaining 50% of units at 120% AMI or below

Preferred Equity Product

Description:

This investment

is up to $2M

provides equity investment into a project ownership entity .

is intended for multifamily buildings of 75 units or less, but not exclusively.

can be used for new construction or renovation/acquisition of existing properties.

Affordability requirements:

5% of units at 50% AMI or below

15% of units at 60% AMI or below

Overall, at least 50% of units must be at 80% AMI or below