Apply Now

To inquire about applying, please contact Brandon Ivory via email bivory@lisc.org or phone (313) 265-2890

How to Apply

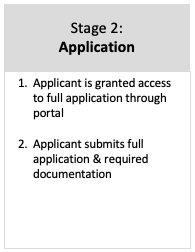

Please contact Brandon Ivory via email bivory@lisc.org or phone (313) 265-2890 about the application process.

RELEASE AND PERMISSION TO SHARE DEVELOPER CONTACT & PROJECT DETAILS

Applicant gives permission for Detroit Housing for the Future Fund (DHFF) and LISC Fund Management (LFM) to share applicant contact information and project details with investors and partners of DHFF. This excludes publication and/or marketing use of such details.

Our Offerings

Recoverable Grants & Grants

Capital Needs Assessment Recoverable Grant Program

Loans

Low Interest Subordinate Mini-Perm Loan

Low Interest Preservation Acquisition Mini-Perm Loan

Preferred Equity

Preferred Equity Product

Disclaimer: Projects funded through DHFF are utilizing private capital and not federal funds.

Capital Needs Assessment & Green Capital Needs Assessment Recoverable Grant Program

Description:

This grant

cover costs of a 3rd party Capital Needs Assessment.

is for owners of regulated affordable housing or Naturally Occurring Affordable Housing (NOAH) projects in Detroit that need to understand the capital needs of their projects.

Eligibility:

Owners or purchasers of existing regulated or Naturally Occurring Affordable Housing projects willing to preserve unit affordability.

Low Interest Subordinate Mini-Perm Loan

Description:

This loan

Allows for refinancing of existing debt up to $2 million

Covers renovation costs projected at moderate level per unit .

Affordability requirements:

At least 50% of units must be at 80% AMI or below

Remaining 50% of units at 120% AMI or below

Low Interest Preservation Acquisition Mini-Perm Loan

Description:

This loan

allows for refinancing of existing debt up to $5 million

is intended for multifamily buildings of 75 units or less, but not exclusively.

covers renovation costs projected at moderate level per unit.

Affordability requirements:

At least 50% of units must be at 80% AMI or below

Remaining 50% of units at 120% AMI or below

Preferred Equity Product

Description:

This investment

is up to $2M

provides equity investment into a project ownership entity .

is intended for multifamily buildings of 75 units or less, but not exclusively.

can be used for new construction or renovation/acquisition of existing properties.

Affordability requirements:

5% of units at 50% AMI or below

15% of units at 60% AMI or below

Overall, at least 50% of units must be at 80% AMI or below